Create an artful legacy by making a planned gift to Trinity Rep.

To ensure that this cultural cornerstone will thrive for generations to come, we invite you to join our Stanzler Society by making a planned gift to Trinity Rep. By declaring your intention to support Trinity Rep as a part of your legacy, you join those committed to safeguarding the unparalleled artistic productions, uplifting community engagement initiatives, and vital educational activities that form the core of our mission and values.

You can be a part of this history. Making a planned gift is for anyone – regardless of age, income level, or assets.

Since 1963 – first at the Trinity United Methodist Church and now at the Lederer Theater Center as a cornerstone of Providence’s downtown arts and entertainment district – Trinity Rep has been your home for dramatic discoveries. Through the decades Trinity Rep has shared incredible stories with the community, brought in countless high school students to experience the magic of live theater through Project Discovery, trained the next generation of theater artists through our renowned Brown/Trinity Rep MFA program, all while employing over 100 artistic and administrative staff, and generating more than $13 million in economic activity each year.

“Trinity Rep holds a special place in our hearts. Our family has enjoyed seeing world-class artists grow and develop onstage and strengthen our community for many years. With our planned gift, we want to help ensure that future generations will benefit from all that makes Trinity Rep a leading institution in our home state: one that fosters artistic excellence, civil discourse and creative problem-solving in a world that needs all of these things more than ever.”- Suzanne Magaziner, former board chair

To discuss including Trinity Rep in your estate plans or to learn more about ways that you can make a legacy gift, please contact Brad Delzer at bdelzer@trinityrep.com or (401) 453-9285.

Strategies for making a planned gift can be tailored to meet a broad range of goals and circumstances, from as simple as leaving a bequest to more complex solutions like trusts. You can also direct your gift to impact a part of Trinity Rep you are most passionate about by contributing to one of our named funds or establishing one of your own.

Most donors leave their gifts to Trinity Rep without restriction. Donors who wish to designate the use of any gift, whether made during their life or through their estate, will have that wish honored to the fullest extent possible. Bequest provisions designated for a specific program or activity require additional language. It is best to contact Trinity Rep in advance for assistance to ensure that your wishes are properly understood.

About The Stanzler Society

The Stanzler Society consists of those thoughtful and dedicated supporters who have designated a special gift to benefit the theater in the future through bequests, life insurance, trusts, IRAs or other planned giving arrangements. These important gifts ensure that Trinity Rep will continue to be Rhode Island’s premiere theatrical experience for generations to come.

Membership is easy. Simply make Trinity Rep a part of your plans by naming us as a beneficiary in your will, trust, insurance policy, or other estate planning tool. You can make your gift anonymously or we can publicly acknowledge your commitment.

Membership benefits

- An annual Stanzler Society newsletter

- Customized updates on your programs of interest

- Invitations to special events

- Updates from Trinity Rep’s leadership and program staff

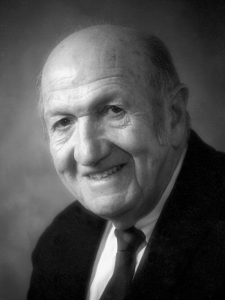

Milton Stanzler (1921 – 2012)

Mr. Stanzler moved to Rhode Island at the age of ten with his family, attended Hope High School in Providence, and went on to study at what is now known as the University of Rhode Island. Upon graduation, he attempted numerous career paths including dental school at The Ohio State, work as a Japanese translator during World War II, and finally legal studies at Boston University.

Mr. Stanzler first proposed establishing a professional theatre in Providence in 1962. Two years later the theatre opened for business with Adrian Hall hired to be its first artistic director. Mr. Stanzler served as Chairman of the Board for the theater’s first 12 years and wrote the book Providence Is No Longer Just A Train Stop: The Trinity Repertory Company—Its First Twelve Years. In 2005, he was inducted into the Rhode Island Heritage Hall of Fame. He also helped found the Rhode Island affiliate of the American Civil Liberties Union in 1959.

WAYS TO MAKE A PLANNED GIFT

There are many ways to make a planned gift, and you can choose multiple options to increase your impact.

About this gift

Your will gives you peace of mind knowing that loved ones are taken care of, your assets are distributed accurately, and that your gift to Trinity Rep reflects your personal values. Gifts to charitable organizations are excluded from estate tax.

How it works

- You can provide now for a future gift to the Trinity Rep by including a bequest provision in your will or revocable trust.

- Your will directs assets to your heirs.

- Your will directs a bequest to Trinity Rep for the purpose(s) you specify.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your bequest if your circumstances change.

- You can direct your bequest to a particular purpose (be sure to check with Trinity Rep to make sure your gift can be used as intended).

- There is no upper-limit on the estate tax deductions that can be taken for charitable bequests.

- You can have the satisfaction now of knowing that your bequest will support the theatre in the way you intended.

How to do it

Sample Bequest of Remainder of Estate

“I give, devise, and bequeath to Trinity Repertory Company (Tax ID #22-2547262) all [or state the fraction or percentage] of the rest, residue, and remainder of my estate, both real and personal.

Sample Bequest of Specific Amount

“I give, devise, and bequeath $_____ to Trinity Repertory Company (Tax ID #22-2547262).

These are merely suggestions as to content and should be written or adapted by legal counsel to fit the contributor’s individual situation.

About this gift

It is important to review retirement accounts, such as IRAs, 401(k)s, 304(b)s, or other retirement plans periodically. Due to high tax rates, many supporters have found that it makes financial sense to allocate the residual amount of their retirement savings to Trinity Rep. Trinity Rep does not pay tax on these gifts, and can put every dollar of your gift to work creating great art.

How it works

- You name Trinity Rep as the sole or partial beneficiary of your IRA, 401(k), or other qualified plan using the beneficiary designation form provided by your financial institution.

- You continue to make withdrawals from your account during your lifetime. Any residual left in your account after passing will flow to Trinity Rep tax-free according to your allocation on your beneficiary designation form.

- Donors age 70 ½ and older may direct lifetime distributions from their IRAs to Trinity Rep. This distribution will count toward your required minimum distribution, and will not be included in your taxable income. You can make contributions totaling up to $100,000 to Trinity Rep annually.

Benefits

- You can escape both income AND estate tax levied on the residual left in your retirement account by leaving a gift to Trinity Rep because Trinity Rep is a non-profit organization and do not pay taxes on the transfer. These taxes can eat up the principal of your account when transferred to your heirs.

- You can continue to take withdrawals during your lifetime.

- You can designate all or a percentage of your account, and can change your beneficiaries at any time. There is no charge to update your beneficiary form.

How to do it

You can easily designate Trinity Rep as a beneficiary for your retirement plan. Simply request a new beneficiary designation form from the plan administrator, and name “Trinity Repertory Company, a not-for-profit corporation in Providence, Rhode Island” as your primary or contingent beneficiary, in whatever amount or percentage you choose.

About this gift

You can use a life insurance policy that is no longer needed to show your support. If you want to keep your current policy but make a future gift, you can leverage your policy by simply naming Trinity Rep as a beneficiary.

How it works

- You transfer ownership of a paid-up life insurance policy to Trinity Rep or purchase a policy and name Trinity Rep as the owner of the policy.

- In the case of a paid-up life insurance policy, Trinity Rep elects to cash in the policy now or to keep the policy and receive the life benefits later.

Benefits

- You receive an immediate income tax deduction for the cash value of the policy.

- In some cases, you can use the cash value in your policy to fund a gift that pays you income.

- You could receive income tax deductions on the premiums you pay.

- You have the satisfaction of making a significant gift now to Trinity Rep without adversely affecting your cash flow.

How to do it

You can easily designate Trinity Rep as a beneficiary for your life insurance policy. Simply request a new beneficiary designation form from the plan administrator, and name “Trinity Repertory Company, a not-for-profit corporation in Providence, Rhode Island” as your primary or contingent beneficiary, in whatever amount or percentage you choose.

About this gift

If you’re looking for a way to maintain your current lifestyle, increase your financial security, and lower your taxes, consider creating a charitable gift annuity. You will receive fixed annual payments for as long as you live and your gift will make a difference in our future. With a deferred gift annuity you start receiving fixed payments at a set date later in life. Delaying payments until a later date allows for you to benefit from higher rates of return that continue to increase the longer you defer them.

How it works

- You transfer cash or securities to Trinity Rep through The Rhode Island Foundation who manages our annuity and endowment programs.

- You, or up to two annuitants, are paid a fixed income for life starting either immediately or at a later date.

- The remaining funds pass to Trinity Rep when the contract ends.

Benefits

- You receive an immediate income tax deduction for a portion of your gift.

- Your annuity payments are guaranteed for life, backed by a reserve and the assets of The Rhode Island Foundation.

- Your annuity payments are partially tax free.

- You can have the satisfaction of making a gift now that benefits you and Trinity Rep.

About this gift

Your charitable remainder annuity trust is a great way to provide yourself or your beneficiaries with a steady, fixed amount of income each year regardless of the performance of the trust. This can be done for a specified length of time up to 20 years, your lifetime, or your beneficiaries’ lifetime. When the contract ends the remaining funds will be transferred to Trinity Rep.

How It Works

- You transfer cash, securities, or other appreciated property into your trust.

- The trust makes fixed annual payments to you or anyone you name.

- When the trust ends, the remaining funds pass to Trinity Rep.

Benefits

- You receive an immediate income tax deduction for a portion of your contribution to your trust.

- You don’t pay capital gains tax on any appreciated assets you donate.

- You or your designated income beneficiaries receive stable, predictable income for life or a term of years.

- You have the satisfaction of making a gift that benefits you and Trinity Rep.

About this gift

The value of the assets you use to fund your charitable remainder unitrust will determine the income payment percentage that you or your beneficiary will receive annually for making the gift. The percentage of payment can be up to 50% of the assets fair market value. Your trust’s assets will be valued on an annual basis to determine the amount you will receive. This gift also allows the flexibility of additional gifts if you wish to add to your gift at any time.

How it works

- You transfer cash, securities, or other appreciated property into your trust.

- Your trust pays a percentage of the market value of the assets re-valued annually to you or to beneficiaries you name.

- When your trust ends, the remaining funds pass to Trinity Rep.

Benefits

- You receive an immediate income tax deduction for a portion of your contribution to your trust.

- You do not pay capital gains tax on appreciated assets you donate.

- You or your designated beneficiaries receive income for life or a term of years.

- You can make additional gifts to the trust as your circumstances allow and qualify for additional tax deductions.

- You have the satisfaction of making a gift that benefits you and Trinity Rep.

The above information is of a general nature and is not intended as legal advice.

Nothing included or referenced in this website is intended or written to be used, and cannot be used, for the purpose of avoiding any tax or penalties, or to promote, market or recommend any person, entity, plan or arrangement. Please consult with and seek advice based on your particular circumstances from an independent legal or tax advisor.